Description

Students’ Guide to Ind ASs Converged IFRS By D S Rawat

Students’ Guide to Ind ASs Converged IFRS By D S Rawat

Description

Students’ Guide to Ind ASs [Converged IFRSs] offers a thorough exploration of the Indian Accounting Standards (Ind AS), which are converged with International Financial Reporting Standards (IFRS). The book imparts a robust understanding of each Ind AS, emphasising practical application, conceptual clarity, and exam-focused material. This Edition is meticulously updated to align with the latest syllabus mandates and professional guidelines, serving as a comprehensive resource for advanced learners in financial reporting.

This book is intended for the following audience:

- CA Final Students – Ideal for those preparing for the Financial Reporting paper, specifically targeting the Sept. 2025 and Jan. 2026 exam sessions

- CMA Final Students – Curated to meet the requirements of the CMA Final curriculum, ensuring each relevant Ind AS topic is covered in depth

- Accounting Professionals & Practitioners – A valuable reference for professionals involved in financial reporting or those transitioning to Ind AS-based financial statements

- Academics & Researchers – Instructors, researchers, and anyone wishing to gain detailed insights into India’s IFRS-converged standards can benefit from this well-structured material

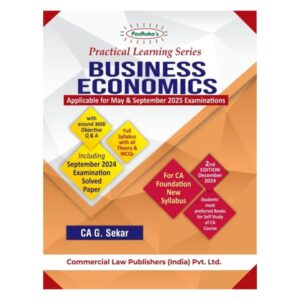

The Present Publication is the 12th Edition, amended upto 30th April 2025 for Sept. 2025/Jan. 2026 Exams. This book is authored by Dr D.S. Rawat & CA. Jinender Jain has the following noteworthy features:

- [Comprehensive Syllabus Coverage] Addresses all Ind AS prescribed for CA Final and CMA Final. It also includes recent amendments, updates, and clarifications to ensure accuracy and relevance

- [Exam-oriented Approach] Maps concepts to typical exam patterns and provides illustrative examples, practice questions, and guided solutions aligned with ICAI and ICMAI expectations

- [Clear Explanations & Practical Insights] Breaks down complex standards into accessible language. It incorporates industry-relevant examples and case studies demonstrating the application of each standard

- [Logical Sequence & Chapter-wise Segmentation] Offers a systematic flow from foundational topics to advanced standards. It also incorporates summaries and highlights at the end of each chapter to reinforce key points for quick revision

- [Insights from Expert Authors] Guidance from seasoned accountants and IFRS experts with a blend of academic rigour and industry practice and includes practical insights

The book’s content spans 42 chapters, laid out progressively:

- Introductory Framework

- Chapter 1 – Introduction to Ind AS

- Chapter 2 – Conceptual Framework for Financial Reporting under Ind AS

- Core Standards

- Presentation of Financial Statements (Ind AS-1)

- Inventories (Ind AS-2)

- Statement of Cash Flows (Ind AS-7)

- Accounting Policies, Changes in Estimates & Errors (Ind AS-8)

- Events after the Reporting Period (Ind AS-10)

- Income Taxes (Ind AS-12)

- Others, covering each individual standard up to Ind AS-116

- Special Topics

- Financial Instruments (Ind AS-32, Ind AS-107 & Ind AS-109)

- Consolidated Financial Statements (Ind AS-110), Joint Arrangements (Ind AS-111), Disclosure of Interests in Other Entities (Ind AS-112)

- Revenue from Contracts with Customers (Ind AS-115)

- Leases (Ind AS-116)

- Deleted/Non-Applicable Standards

- Chapters on Ind AS-29, Ind AS-104, Ind AS-106, Ind AS-114, etc., are marked as deleted or not in the current CA Final syllabus, ensuring readers focus on relevant content

- Supplementary Chapters

- Analysis of Financial Statements

- Accounting and Technology

- Professional and Ethical Duty of a Chartered Accountant

- From conceptual underpinnings to practical examples, each chapter provides a structured discussion, definitions, recognition principles, measurement rules, presentation norms, and disclosure requirements for the respective standard

The structure of the book is as follows:

- Chapter Layout – Each chapter commences with objectives and an overview of the Ind AS topic, followed by detailed explanations, step-wise illustrations, etc.

- Practical Illustrations & Case Scenarios – Realistic examples ensure clarity. Readers can see how Ind AS principles translate into day-to-day accounting tasks or complex financial transaction

- Summaries & Revision Points – Key takeaways at the end of every chapter help consolidate learning and facilitate quick revision before exams

- Question Bank & Solved Answers – A curated set of practice problems per chapter – including past exam questions and newly framed scenarios – is provided, with solutions or guiding notes enabling self-assessment and exam readiness

- Logical Progression – The text transitions from basic definitions and frameworks to more advanced standards such as financial instruments and consolidation. This ensures that foundational knowledge supports understanding of complex areas

![Taxmann Students’ Guide to Ind ASs [Converged IFRS] By D.S. Rawat, Jinender Jain Sep 25 / Jan 26 Exam](https://www.shantibookhouse.in/wp-content/uploads/2025/05/Taxmann-Students-Guide-to-Ind-ASs-Converged-IFRS-By-D.S.-Rawat-Jinender-Jain-Sep-25-Jan-26-Exam.jpg)